Mostbet India - bookmaker and casino in India

| Mostbet | |

| India | |

| 2009 | |

| Curacao | |

| 37 including: English, Russian, French, German, Spanish, Japanese | |

| 300 INR | |

| 25 000 INR | |

| Android, iOS | |

| Allowed | |

| Allowed | |

| LIVE chat, hotline, email support |

Mostbet INDIA official website

Mostbet, an online bookmaker, has been accepting sports betting on its official website with a .com domain since 2009. The bookmaker’s official website is available in more than 20 languages. Mostbet India betting company is licensed by Curacao and operates in 93 countries. The bookmaker’s office, where more than 800,000 bets are placed every day, offers the opportunity to open a gaming account in 19 different world currencies.

How to register at MostBet IN?

A variety of registration methods are available, including phone number, email, social networking, or “One Click” for instant registration. The registration process is as follows:

- Click on the “Register” button.

- Choose a country and currency for your account.

- Agree with the rules of the company and confirm that you are at least 18 years old.

- Choose the welcome reward for the sports or casino transactions.

- Click on the “Sign Up” button to complete the process.

In the event of significant cash withdrawals or potential illegal activity, the security department has the right to initiate a customer verification process. This may include requesting a passport photo and documents verifying the customer’s address.

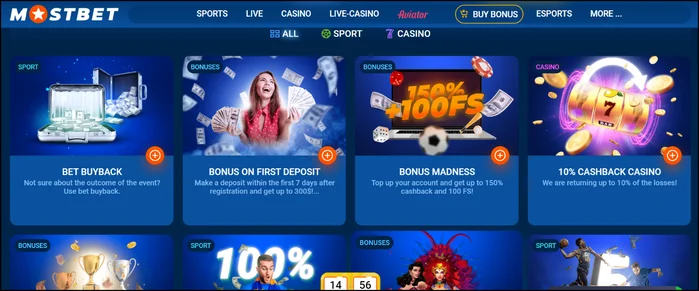

Bonuses for betting and casino

New customers can get 100% reward on their first deposit. If the first deposit is made within 15 minutes after registration, the welcome bonus increases to 125% of the deposited amount.

To meet the requirements, you must wager the bonus on three or more express bets with odds of 1.40 and the bet amount must be five times the deposited amount. The wagering conditions must be met within 30 days.

Mostbet.in offers various bonus offers to both new and existing customers, including:

- Bonus of 1% to 20% for winning express bets, depending on the number of outcomes with odds from 1.20.

- Insurance of bets, which guarantees payment even in case of losing a bet.

- Early settlement of transactions, where the cost of repayment depends on the current odds for winning a bet.

- Parlay insurance, which guarantees a full refund if one outcome in a parlay with seven or more events with odds from 1.70 is lost.

The bookmaker’s office Mostbet has a loyalty program, within which Mostbet coins are awarded. These points can be exchanged for bonus money, which can be used for free bets. Advancing to higher levels in the loyalty program also entitles you to free bets.

Line and LIVE - betting at Mostbet India

Mostbet bookmaker offers betting options on 20 popular and exotic disciplines. The range of professional leagues varies by sport and country, with some going as high as tier 2 or tier 3.

Although the betting selection at the bookmaker’s office is average, there are still a significant number of options: up to 1,000 positions for top soccer, 300 each for hockey and basketball, and 100 for tennis. As an example, the spreadsheet for a Europa League match contains outcomes, double odds, handicaps and totals, both teams to score, half/match, score and total, goals in both halves, exact score, half-time comparisons, goals in segments, results by segments, dry and willful wins, both scores and total, and corner kicks.

The available markets are divided into different categories such as popular, totals, handicaps, 1st half, 2nd half and corners.

Mostbet online bookmaker office offers an extensive live line, which covers most of the significant matches. This line has detailed main and extra marquees, as well as statistical offers. In the case of a Champions League match, the bookmaker puts up to 300 markets.

Live video broadcasts of matches are not available on the bookmaker’s website. Instead, players can access graphical broadcasts and basic statistics of current matches.

The odds

Mostbet is an international bookmaker and the odds are usually below average, with margins ranging from 4-6% for pre-match bets and 6-8% for in-play bets. The level of quotations varies depending on the sport, the prestige of the competition and the chosen market. The highest maximums are offered in the main markets of popular soccer, hockey, basketball and tennis matches.

How to bet at Mostbet.in?

In order to place a bet in Mostbet official website, you need to follow the following simple steps:

- Go to “Line” or “Live” section on the website.

- Choose the sport and championship you are interested in.

- Select the playlist for the selected matches.

- Add the desired outcome in the betting box.

- Enter the amount you want to bet and confirm the bet.

To make the betting process faster, you have the option to set your desired betting amounts in the slip.

MostBet Casino

For those interested in casino games, Mostbet offers many options such as slots, card games, roulette and lotteries. You can use the search bar or browse the “New,” “Popular,” and “Favorites” sections to easily find the type of gambling entertainment you want.

Mostbet bookmaker offers a live dealer section for those interested in gambling entertainment, including roulette, baccarat, blackjack, poker and TV games. In the live casino, you have the opportunity to play classic versions of the games, as well as variations such as lightning-fast roulette and speed baccarat.

A separate column in the main menu contains the classic “Aviator” risk game, where the payout ratio increases steadily as the plane takes off.

Pros and cons of Mostbet in India

Pros of:

- An attractive bonus program for new and existing users.

- A diverse line of high-quality events.

- Quick registration process without verification.

Cons:

- Limited access to video broadcasts of matches.

- Offers lower odds.

- No statistics of pre-match events.

Mostbet mobile app

The bookmaker Mostbet offers players to use a mobile app for a comfortable game of betting. You can download the mobile app on the official website of Mostbet.

Download for Android

The Mostbet mobile app for Android has a user-friendly interface and provides all the features available on the official portal. The app allows users to place bets, make money transactions, watch live streaming and get bonuses as part of the gaming program.

To download the mobile client for Android, visit the official site where it can be found. The mobile app is compatible with devices running Android 5.0 and later versions. The size of the mobile program is 50 MB.

Download for iOS

The Mostbet app for iOS can be downloaded from the international App Store. The mobile app offers both basic features and additional features such as one-click betting, the ability to change the odds format and design theme, as well as online chat support. It works on iOS 10.0 and later versions.

PC version

The bookmaker’s office does not provide applications for personal computers. You can make bets on the official website of the company.

Deposit and withdrawal methods

There are various payment methods available for making deposits at Mostbet, and the best part is that none of them entails any commissions. You can use the following payment methods to make deposits:

- Payment cards.

- Piastrix online wallets.

- Cryptocurrency wallets.

To make a deposit on Alpari, you need to go to the “Deposit” section located in your account. The minimum deposit amount for bank card transactions is Rs. 300.

To withdraw your earnings from the bookmaker’s office, go to the “Withdraw from Account” section on the “My Account” page. There are several withdrawal options which include:

- Payment cards.

- Electronic wallets such as ecoPayz and WebMoney.

- Cryptocurrency wallets.

In order to successfully withdraw funds, a player must wager at least 70% of the deposited amount. If this requirement is not met, the bookmaker reserves the right to reject the withdrawal request.

FAQ

You can make deposits in the bookmaker’s office from bank cards, e-wallets and cryptocurrencies.

The bookmaker does not have a local license, but the company’s activities in the country are not prohibited.

Yes, the bookmaker provides the opportunity to open an account in Indian rupees.

The minimum bet size is 50 rupees.

Bizbon N.V., Curacao. The website operates under the license No. 8048/JAZ2016-065

Payment support operator Venson LTD. Registration Number HE 352364. Legal address: Stasinou 1, MITSI BUILDING 1, 1st Floor, Flat/Office 4, Plateia Eleftherias, 1060, Nicosia, Cyprus Merchant location: Kadmou Street 4, S.I. OLYMPIA BUSINESS CENTER, Agios Andreas, 1105, Nicosia, Cyprus